Kiddy Store Fortune Review

Kiddy Store Fortune Review 2025 + OTO’s Coupon + $250 Free Bonus Introducing Kiddy, the world’s first done-for-you package that gives you instant access to

In the financial realm, Warren Buffett stands as an unparalleled figure, a billionaire whose stock-picking prowess has not only secured his fortune but has also generated staggering wealth for countless investors. Since assuming control of Berkshire Hathaway in 1965, the company’s shares have consistently outperformed the S&P 500, doubling its annual return. Despite his remarkable success, Buffett’s investment advice remains refreshingly straightforward. At Berkshire’s 2021 annual meeting, he reiterated a consistent recommendation: “I recommend the S&P 500 index fund, and have for a long, long time to people.”

Dive into the simplicity of Buffett’s counsel, as he underscores the enduring power of the S&P 500 index fund. Investors, seeking not just guidance but a reliable path to wealth, may find this recommendation surprisingly consistent. Uncover the potential as we unravel how this sage advice could systematically grow a modest $400 monthly investment into an impressive sum of $847,800, providing patient investors with a compelling strategy for financial success.

Introducing the Vanguard S&P 500 ETF (NYSEMKT: VOO) – your portal to the dynamic landscape of U.S. businesses. This ETF isn’t just a symbol; it’s a glimpse into the performance of 500 American companies across all 11 market sectors. Beyond statistics, it’s an exploration of value and growth stocks, covering 80% of the domestic equities market and over 50% of the global equities market. In essence, this index fund transcends mere investment; it’s an immersion in the success stories of leading enterprises worldwide. Picture Microsoft, the trailblazer in enterprise software; Apple, the titan of consumer electronics; Alphabet, the innovator in digital advertising; Amazon, the marvel of cloud computing; and Nvidia, shaping the future with artificial intelligence chips. The Vanguard S&P 500 ETF isn’t just about numbers – it’s your pass to narratives of innovation and progress.

Instead of the intricacies of individual stocks, Buffett points to the S&P 500 index fund as the ideal option. This choice opens the door to a diverse array of businesses, collectively positioned for success. Over time, the S&P 500 has demonstrated its reliability, making it a solid choice for investors who embrace patience and dedication in their approach.

Investing in the S&P 500 has consistently shown profitability over 20-year periods since its inception in 1957, and its precursor demonstrated the same trend since 1926. Over the past three decades, the S&P 500 has experienced a remarkable 1,720% increase, compounding at an annual rate of 10.14%. This growth implies substantial returns: a $400 monthly investment could potentially grow to $80,500 in one decade, $292,000 in two decades, and an impressive $847,800 in three decades.

Acknowledging that not everyone may have $400 per month to invest, or some may aspire to save more, the S&P 500 emerges as a compelling avenue for steady and lucrative long-term growth.

Buffett’s view on stock picking for the average person doesn’t mean investors should be discouraged. For those willing to put in the necessary research, buying individual stocks, especially in combination with an S&P 500 index fund, can be a viable approach. Successful investing requires an understanding of individual companies and their industries. Developing this knowledge takes time, and not everyone has the capacity to regularly research every stock market sector. Here, an S&P 500 index fund becomes a valuable resource, helping to fill knowledge gaps and diversify investment portfolios. To be clear, diversification isn’t necessary for making money in the stock market, but it does help manage the risks associated with a concentrated portfolio—something I find quite compelling. In my strategy, a significant portion of my portfolio is invested in individual stocks, mainly from the technology sector, while the remainder is in the Vanguard S&P 500 ETF. I appreciate this approach for two reasons. Firstly, if my individual stocks outperform the S&P 500, my entire portfolio stands to beat the market. Secondly, even if my individual stocks fall short of the S&P 500, my portfolio can still perform well because the S&P 500 has maintained a 10.14% annual return over the last 30 years.

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.

Kiddy Store Fortune Review 2025 + OTO’s Coupon + $250 Free Bonus Introducing Kiddy, the world’s first done-for-you package that gives you instant access to

MagicBooks AI Review 2025 + OTO’s Coupon + $43K Free Bonus Introducing MagicBooksAI, the world’s first app that lets you instantly create, publish, and sell

How to Keep Your Dog Mentally Stimulated: Tips for a Happy and Healthy Pet in 2025 When I brought home my puppy, I was full

Human AI Review 2025 + OTO’s Coupon + $9,997 Free Bonus Introducing the world’s first AI app that lets you create and stream ultra-realistic AI

The 9 States With No State Income Tax (Ranked Best to Worst) If you’re considering a move to a state with no income tax, you’re

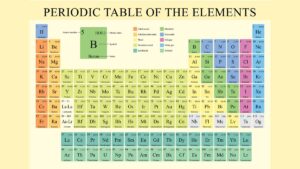

How the Periodic Table of the Elements is Arranged: A Comprehensive Guide The Periodic Table of the Elements is more than just a list of